Some Known Details About Steve Young Realtor

Wiki Article

Rumored Buzz on Steve Young Realtor

Table of ContentsNot known Details About Steve Young Realtor Not known Details About Steve Young Realtor The Ultimate Guide To Steve Young RealtorAbout Steve Young Realtor5 Easy Facts About Steve Young Realtor Shown

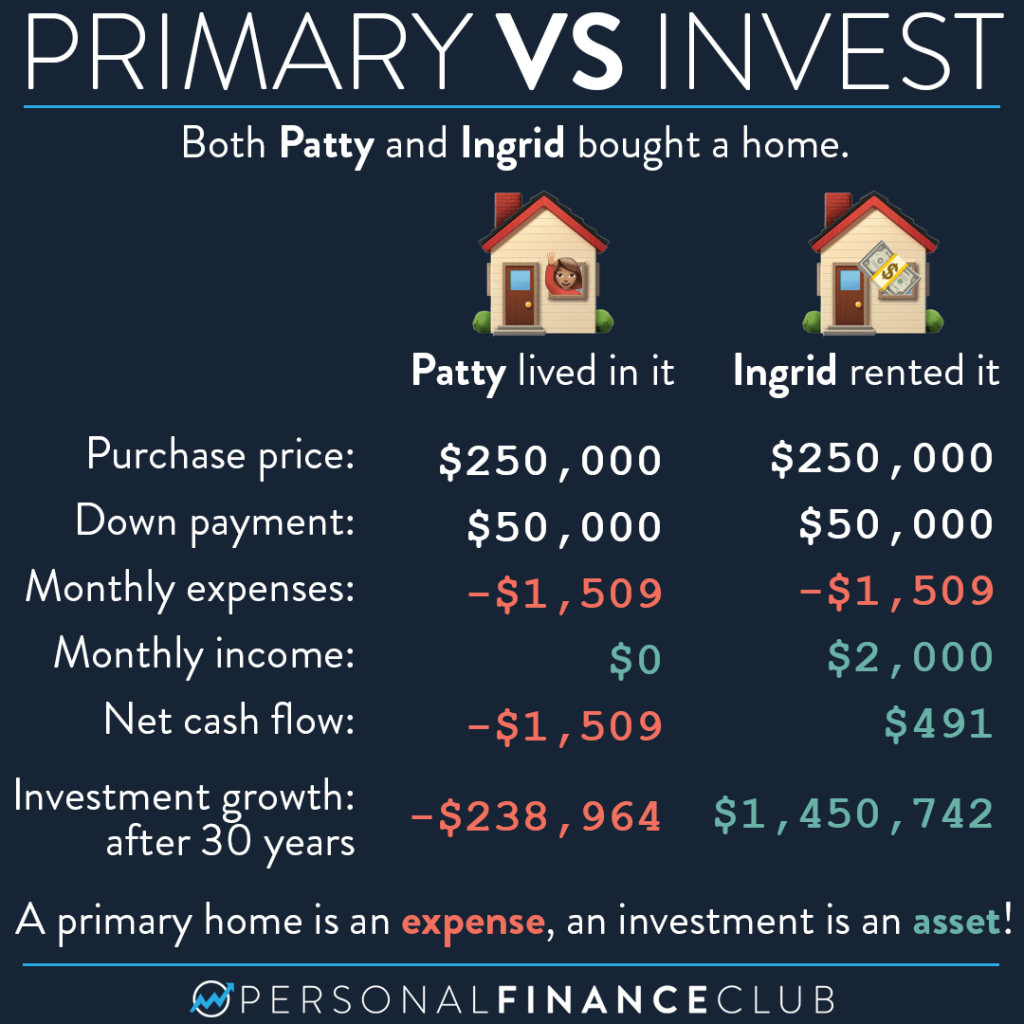

Actual estate is typically a wonderful financial investment alternative. It can produce recurring passive earnings as well as can be a good lasting investment if the value raises in time. You might also utilize it as a component of your total strategy to start developing riches. Nonetheless, you require to make sure you prepare to begin purchasing real estate.Getting a residence, house complex, or item of land can be pricey. That's and also the continuous maintenance costs you'll be accountable for, along with the capacity for revenue voids if you are between renters temporarily. Here's what you need to find out about buying realty and also if it's the appropriate choice for you.

If you can't afford to pay money for the residence, at the very least, you ought to be able to afford the home loan payments, also without rental income - steve young realtor. You might likewise experience a time where you have no renters at all for the residential property.

About Steve Young Realtor

, which will certainly cost you money in the long run. Frequently, it is easier to go with a rental business and have them deal with points like repair work and also lease collection.Particularly if you don't have time to do whatever that requires to be done at your property, utilizing a company is an excellent alternative. You require to value your rental home to make sure that all of these costs and other expenses are fully covered. steve young realtor. Furthermore, you need to take the first few months of excess money and also established it apart to cover the cost of fixings on the building.

You ought to additionally be prepared to manage additional costs as well as various other circumstances as they emerge, maybe with a sinking fund for the building. Research Study the Residential Property Meticulously If you are purchasing land that you prepare to sell at a later day, you require to investigate the land deed extensively.

Also be certain there isn't a lien on the home. You may also want to consider things like the comparables in your area, consisting of whether the area is up-and-coming, and also various other external factors that could affect the residential or commercial property worth. As soon as you have actually done your study, you need to be able to make the right choice regarding purchasing it as an investment.

The Only Guide for Steve Young Realtor

You may make money on your financial investment, yet you might shed cash. Things may alter, and also a location that you thought might enhance in value might not actually go up, and also vice versa.Rather, they possess debt protections, which are riskier. Hybrid REITs integrate equity and home loan REITs. How do you buy property? You can take numerous routes to get going in real estate. One would be to buy a multi-unit home as well as lease the other systems. You could also buy a single-family residence to rent.

You could additionally lease areas in your own home to construct up the funds to buy more property. REITs additionally permit you to buy property, but without having go to my site to conserve up the money to acquire a building or maintain one.

The 15-Second Trick For Steve Young Realtor

The key is to do your study to learn which type of property investing is the ideal fit. REITs Purchasing right into REITs, short for genuine estate investment company, is just one of the most convenient means to spend in realty. Why? With a REIT, you buy genuine estate without needing to stress over preserving or handling any kind of physical buildings.

When you get right into a REIT, you buy a share of these residential properties. It's a little bit like purchasing a mutual fund, only rather than stocks, a REIT take care of actual estate. You can make cash from a REIT in two means: First, REITs make regular returns repayments to financiers.

You can invest in a REIT just as you would spend in a stock: REITs are noted on the major stock exchanges. The National Organization of Real Estate Financial investment Trusts says that regarding 145 million United state homeowners are invested in REITs.

Our Steve Young Realtor Diaries

You can after that either live in the residential property or lease it out as you wait for it to value in value. If you lease the building, you may be able to use these regular monthly checks to cover all or part of your month-to-month home mortgage settlement. When the residential or commercial property has appreciated sufficient in worth, you can market it for a big cash advance.You can lower the odds of a poor financial investment by looking into regional communities to find those in which residence values tend to see this climb. You ought to likewise function with property agents as well as various other professionals that can you reveal historical admiration numbers for the neighborhoods you are targeting. You will certainly need to be conscious of location.

Report this wiki page